By Adam Graves, Global Risk Management Inc.

Cocoa futures prices can be very susceptible to volatile movement stemming from headlines that appear to impact supply and demand due to the infrequent nature of data and information released by official sources. Over the last two weeks as it neared delivery, the December’20 cocoa futures contract rallied over 25% in part as a reaction to the news that Hershey, among other firms, was opting to take delivery on ICE exchange stocks in lieu of paying the $400/MT Living Income Differential (LID) to source cocoa from Ivory Coast or Ghana, the world’s two largest cocoa suppliers. While this decision has had a ripple effect that has now led to the two West African countries suspending their sustainability schemes, which will ultimately make it more difficult to source ethically and sustainably grown supplies, it also resulted in ICE exchange stocks being drawn down to their lowest levels since January. Given that exchange stocks are one of the only frequently reported metrics for cocoa, one might wonder how impactful this figure is when looking at futures prices.

ICE cocoa stocks do tend to follow a seasonal pattern – stocks build through the first 3-5 months of the calendar year before declining through the year’s end – but the 10%+ drop off seen this month has only occurred 14 times since the beginning of 2005 (7% of months). All but three of these took place in the fourth quarter of the calendar year. In the prior 13 months where this substantial decline in stocks took place nearby cocoa futures prices actually had declined by an average of 1%, which is certainly in contrast to what has been seen with November’s price rally of over 30%.

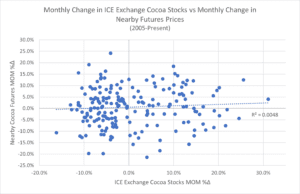

Intuitively, one would expect that as stocks are drawn down that prices would rise. Surprisingly, that was not the case when the ICE cocoa stocks monthly percent change was plotted against the nearby cocoa futures contract’s monthly percent change. In fact, when looking at the relationship between these two variables from 2005 to present, there is a weak positive correlation which means the data actually sees prices rising in tandem with stocks to a fairly insignificant degree. That said, the very low R-squared value of 0.0048 would indicate that only a small fraction of the variance seen in nearby futures prices can be explained by the month-to-month changes in ICE cocoa stocks levels.

The results of this study don’t make a particularly convincing argument for one of the few frequently released cocoa metrics, ICE stocks levels, being a strong indicator of futures price action. Ultimately the news that stocks had been depleted to their lowest levels since January looks like noise rather than a signal as a standalone metric, and the price rally appears to have been driven by other bullish supply headlines working in tandem.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.