By Adam Graves, Global Risk Management Inc.

A variety of factors may impact a producer’s decision to plant one crop versus another. Crop rotation, soil makeup, and several other environmental elements can certainly be influential in this choice, as can other determinants. In a season where ending stocks of corn and soybeans are projected to be at multi-year lows (lowest for both since the 13/14 season) demand will likely see rationing, but prices will need to reach a certain point for that to take place. If you are in the industry you know that prices are rallying; producers may also look at the futures price ratio of the two commodities to help aid their decision-making process for planting corn versus soybeans or vice versa. What sort of correlation has the soy/corn ratio had on changes in planted acreage in the past? Let’s take a look.

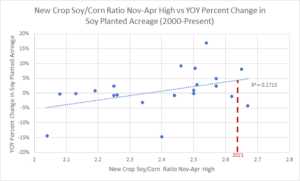

The SX21/CZ21 ratio made a high of 2.63 in the November 2020 through present period, meaning the November’21 soybean futures contract was trading at a rate 2.63 times that of the December’21 corn futures contract. This is near the high end of the spectrum that this metric has seen since 1999, with only two other SX/CZ highs in the Nov(x-1) through April(x) periods (where x represents the planting year) coming in higher.

Intuitively, one would expect that a higher SX/CZ ratio would favor higher soy acreage and lower corn acreage – and broadly speaking this is the case. That said, the correlation coefficient of .41 for the SX/CZ ratio and the yearly percent change in soy acreage and -.40 for the ratio and yearly percent change in corn acreage don’t necessarily paint a convincing picture – statistically speaking values greater than .8 or less than -.8 indicate a fairly strong relationship. Despite this, should we apply the SX21/CZ21 high value of 2.63 to the lines of best fit, it would yield a 4.3% YOY increase in soy acres and a 1.8% YOY decrease in corn acres. This would translate to 86.66 acres and 89.17 planted acres for soy and corn respectively.

The soy/corn futures price ratio certainly favors increased soybean acreage despite an emphasis on corn via the much lower than anticipated Dec 1’20 stocks that were recently reported. Early estimates have pegged acreages for both commodities over the 90M threshold. We will have some more clarity in the USDA’s Acreage Intentions report released at the end of March.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.