By Michael Irgang, Global Risk Management Inc.

The USDA’s February Cattle on Feed report estimated a February 1 feedlot inventory of 12.106 million head, 101.5% of a year ago and above average trade estimates of 100.9%. The reported ‘on feed’ number was also the second largest in the entire data series, which began in 1996. Placements into feedlots during January were 2.017 million head, 103.2% of a year ago, well above average trade estimates of 99.9%, and the highest January placements number since 2006. The stronger placements number is a function of improvements in prices for fed cattle during January and in some cases inclement weather conditions leading to more animals being put on feed for slaughter. At the end of the day, the February Cattle on Feed report improves the outlook for the availability of market-ready fed cattle for slaughter in the upcoming summer months, making the report bearish for beef prices. But, if you dig deeper into the report, the outlook is even more bearish than what is implied by report’s headline numbers.

Here is why:

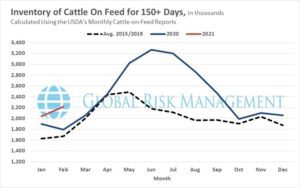

Using the February Cattle on Feed report’s “on feed’ number and the placement numbers from the previous five monthly reports, it is possible to back into an estimate of the number of cattle that have been on feed for more than 150 days. This calculation provides analysts an additional dimension in understanding not only the number of cattle on feed, but also the size of the cattle given that animals generally put on more weight the longer they are on feed. In industry jargon, this calculation gauges where or not the current supply of cattle on feed is ‘front loaded’ with heavier animals about to come to market, which of course translates to higher near-term beef production. Going through this valuable exercise using the February Cattle on Feed report as a starting point gives us an estimate of cattle on feed for 150 days or more at 2.218 million head, an increase of 23.8% over last year. Our analysis would conclude that not only is there an ample supply of market ready cattle available for marketing to packing plants, the animals will likely be marketed at above-trend live weights, all else being equal. The bitter cold weather conditions that gripped many feedlots areas over the last few weeks will cause short-term pinch points in the logistics of moving animals from feedlots to packing plants, leading to cattle being fed to even higher weights. This impact will more than offset the impact of colder weather on weight gain, increasing beef production in the near term. On balance, the February Cattle on Feed report was even more bearish than what the headline numbers alone would indicate.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.