By Brian Harris, Global Risk Management Inc.

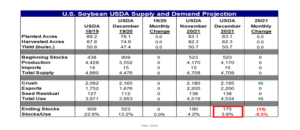

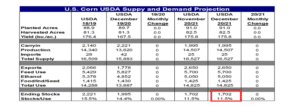

The USDA will release several reports on Tuesday, January 12th that have the potential to influence grain prices for the next few, if not several months. The main area of focus will be on the changes to the 2020/2021 ending stocks projections for the soybean and corn markets so let’s break those down.

For soybeans, we have seen domestic ending stocks projections continue to decline over the last several months on higher exports to China and record domestic crush numbers. In addition, less than ideal weather conditions in South America over the last two months have started to eat into the soybean production estimates there as Brazil will begin to harvest over the next few weeks. Traders are expecting to see another increase in the export estimate as well as the possibility of a slight reduction in yield and or acres on next Tuesday’s report. This could potentially bring that ending stocks number down towards a pipeline supply of 125 million bushels. The question that traders are asking themselves now is, has the 29% November/December soybean futures rally priced in a carryout number that low if we see it?

For the corn market, a very similar situation has evolved where the 2020/2021 projected ending stocks have declined sharply from where ideas were last summer. Lower than expected yields in the U.S. last fall and record export business to China have combined to put current estimates back down to multi-year lows and not far from pipeline supply levels. The USDA could feasibly increase exports and adjust yields slightly lower again to put ending stocks back down towards 1.5 billion bushels. The same question applies here as it does for soybeans, has the 25% November/December corn futures rally priced in that kind of adjustment if we see it?

The soybean and corn markets have been in the process of rationing demand through higher price over the last few months but given how tight the balance sheets have become, we will expect the market to find solid buying interest on setbacks through much of Q1, 2021. There will be a notable battle for acreage in the U.S. in the Spring which is likely to keep a floor under the market and problem free crops next summer will be critical to bringing stocks back up to more comfortable levels.

Additional numbers to watch on next Tuesday’s reports will be the end of December grain stocks estimates, Brazil and Argentina production estimates and the U.S. winter wheat acreage numbers.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.