By Michael Irgang, Global Risk Management Inc.

Pork production is largely a function of live hog weights and the number of animals slaughtered in packing facilities. It is interesting to review how live hog weights actually translate to the amount of pork supplies actually produced for consumption. A live hog weighing 290 lbs. can be expected to yield 216 lbs. on a carcass weight basis using a commonly used conversion factor of 0.744. Carcass weight can then be further converted to a retail weight equivalent (rwe) to arrive at the actually amount of pork that will be available for consumption. At GRM, we typically use a retail weight conversion factor of .776 which, in our example, would yield 168 lbs. of pork harvested for consumption from the hog that weighed 290 lbs. While higher hog weights clearly pencil out to increased pork supplies, at least mathematically, there is something more which could be at play with the pace of increased hog weights that must be considered when estimating the availability of future pork supplies.

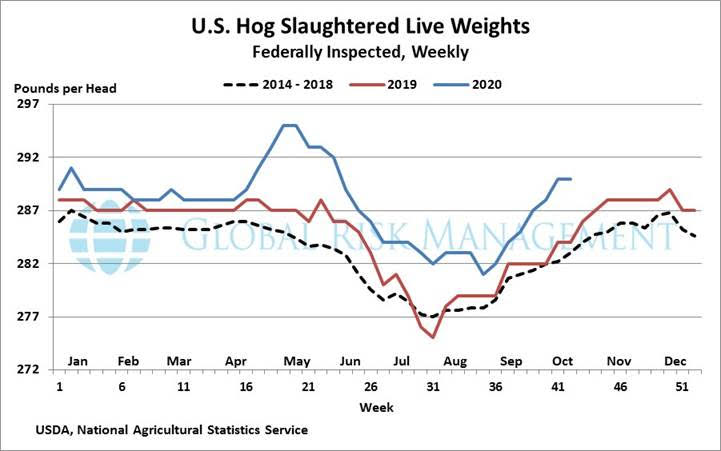

Live hog weights are actually more than a static number that driver pork production as discussed above; in fact, hog weights can provide useful insights into the actual flow of hogs through the pork production process. Live hog weights follow a normal seasonal pattern as packing facilities seek to manage their pork production schedule so as to maximize profits. Pork packers look at hog weights, hog prices, and pork cutout value and run their production schedules accordingly. The dotted black line in the chart below illustrates the normal seasonal pattern for live hog weights taking into account the aforementioned factors. There are occasionally events that cause live hog weights to deviate from normal seasonality. Let’s say for example, a packing facility receives an exceptionally large order for pork from a customer in August, the month in which live hog weights have been averaging 277 lbs./head. Let’s further assume the packing facility has excess available production capacity to meet the customer’s order. The packer will respond to this order with an increased demand for live hogs to the point where hogs will be marketed at lower weights to the packer in order to meet the sudden increase in demand for livestock. In other words, hog producers will likely be compelled to market hogs to the packer at lower weights in order to meet the abrupt surge in livestock demand from the packer. In this example, an increase in pork production actually leads to a decrease in live hog weights due to the sudden demand for hogs created by the large customer order for pork. More on point, the opposite can also be true: higher live hogs weeks could also be a signal for lower production and, yes, ultimately tighter pork supplies.

Live hog weights normally increase by 5 lbs./head during the six weeks following Labor Day. This year, live hog weights have increased 9 lbs./head during the six weeks following Labor Day (through October 17th ), or 80% faster than the normal seasonal weight increase for the time period. Higher-than-normal live hog weights can be a symptom of bottlenecks in the pork production process. Pork producers facing production constraints will hold off on hog purchases, causing hogs to “back up” in feedlots and leading feedlot operators to feed hogs to higher weights. This dynamic actually unfolded earlier this year in April & May as COVID-related issues forced many plant closures and lead to hogs backing up in the feedlots. In fact, the peak of the pork plant shutdowns this year was in the week ended 5/2/2020 in which total hog slaughter was down 34.9% year-on-year. And while overall slaughter has normalized to a large degree since the plant closures earlier this year, there remains a heightened degree of uncertainty as to the actual pork production capacity that is available today. The recent rise in live hog weights happens to coincide with the third wave of COVID-cases in the U.S., raising the concern that the hog weight increase may be indicative of lower-than-expected hog slaughter in the weeks ahead. If in fact higher live hog weights over the last six weeks is the ‘canary in the coal mine’ indicating pinch points in U.S. pork production, tighter pork supplies may be in the cards. If pork production were to decline to only 5% lower year-on-year for the remainder of 2020, total pork produced would be almost 220 million lbs. (rwe) lower. Clearly, market participants will be closely watching live hog weights to navigate the remainder of this highly volatile year.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.