By Brian Harris, Global Risk Management Inc.

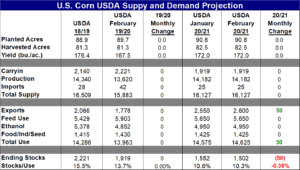

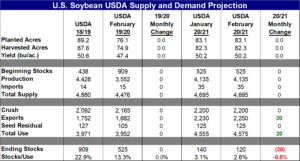

The USDA released their February Supply/Demand updates for the corn and soybean markets on Tuesday and the changes were relatively minor. Current spot contract corn and soybean futures prices have risen 73% and 66% respectively since August of 2020 as stellar demand from China has tightened the balance sheets considerably for both commodities even with COVID-19 in the picture. An acreage battle is looming this Spring and the updated ending stocks projections for both corn and soybeans are already at pipeline levels, allowing for minimal if any weather issues for the 2020/2021 growing season.

The ending stocks numbers issued by the USDA were near the higher end of the range of trade estimates and many believe that they are still not reflective of the true changes in increased demand over the last several months. Even if one were to take these new numbers at face value, it would appear that we still have demand rationing to do for both markets going forward.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.