By Max Olson, Global Risk Management Inc.

No upward revisions to soybean or corn exports means prices are high enough for the moment, but all eyes remain on South American weather and Chinese demand.

The December WASDE updates are typically a boring affair since the USDA does not update their supply estimates this month, and demand changes are usually minimal. However, given the huge declines in soybean and corn stocks the past several months, and the very tight soybean carryout estimates, all eyes were glued to the demand side of the balance sheet this month.

The market was anticipating another increase in the USDA’s export estimates this month, and a subsequent decline in ending stocks. Today’s report failed to meet those expectations as the USDA only increased soybean domestic crush by 15 million bushels, causing ending stocks to fall to 175 million from 190 million in November. The corn balance sheet was left unchanged as stocks remained adequate at 1.702 billion bushels. The lack of bullish news this month caused prices to set back sharply following the report’s release. The January ‘21 soybean futures fell 25 cents after the release and remains in consolidation mode between $11.50 and $12.00 per bushel. The March ’21 corn contract declined 7 cents post-report and has been consolidating between $4.15 and $4.40 since mid-November.

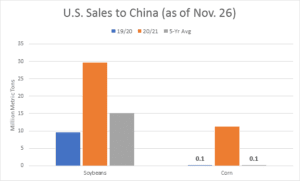

U.S. export sales, primarily to China, have been hot and heavy this early in the marketing year (chart below). Current export commitments for soybeans and corn are running 96% and 156%, respectively, ahead of last year at this point in time. However, following through sales to China have been quite in recent week and allowed the USDA to maintain their current export estimates of 2.2 billion bushels for soybeans (+31% from 19/20) and 2.650 billion bushels for corn (+49% from 19/20). The belief is that after gorging on U.S. supplies earlier this year, China now has enough on the books to get them into Feb/Mar when they will be able to tap into the sizeable new crops expected out of South America. With the U.S. stocks of soybeans already near pipeline levels, any new commitments to China, or future revisions to exports, would put stocks in an even more precarious position. That is why so much attention is being put on Brazil and Argentine weather currently, as any shortfalls there would push additional demand back to the U.S. and prices significantly higher.

*Data Source: USDA

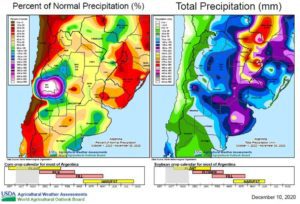

Following one of the driest starts to the year for Brazil and Argentina, recent sporadic rainfall has helped to stave off massive crop reductions, but more moisture is still needed throughout the growing season now. The improvements in rainfall from prior months has allowed the USDA to keep their current production forecasts for 20/21 Brazilian soybeans and corn unchanged at 133 MMT (new record and +7 MMT from 19/20) and 110 MMT (+8 MMT from 19/20), respectively. However, Argentina has not seen as widespread rains (60-day rainfall graphs below), causing both their soybean and corn production estimates to be revised 1 MMT lower this month to 50 MMT (+1.2 MMT from 19/20) and 49 MMT (-2 MMT from 19/20) respectively. Local agencies estimates reflect the potential for further declines, but for the moment the weather has done enough to keep prices contained in the recent ranges. Still a long way to go until harvest in late Q1 so stay tuned!

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.