By Patrick Sparks, Global Risk Management Inc.

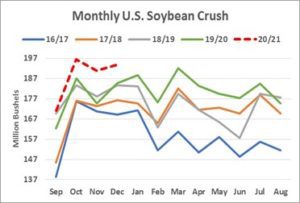

Supported by profitable crush margins, U.S. soybean crushers have been running at a record pace this season. Recently reported U.S. crush data from the USDA showed that 193.8 million bushels of soybeans were processed in December, a new record for the month. This compares to 184.7 million bushels last December (+5%), which was a record at the time for the month. Since the start of the marketing year (Sep – Aug), all four months of reported crush have set new monthly records. Cumulative crush for the year to date has reached 752.4 million bushels, 43.5 million above last year (+6%). To put that into perspective, the USDA’s full year projection is calling for an increase of 35 million bushels.

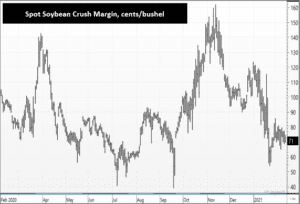

Given that yoy crush to date has already surpassed the USDA full year gain in the first four months, and with U.S. soybean stocks already projected at essentially pipeline levels, this is clearly an unsustainable pace. The job of the market will be to ration crush for the remainder of the year, but meeting the USDA’s target appears to be a tall task given current conditions. Soybean board crush margins have plummeted, falling from about $1.50/bushel in early November to about $1.10 in December and are now trading around $0.75 in the nearby. While sharply off its peak, this is still a profitable margin for most operations. Supporting these margins is very strong soybean product demand (meal and oil). Domestic soymeal demand remains stout as DDG’s supplies remain below normal given reduced ethanol production. For soybean oil, food demand has been more resilient in the face of COVID restrictions vs. earlier expectations while soyoil as a feedstock for biodiesel production remains extremely strong.

We would not be surprised to see crush to stay relatively strong in January and possibly February as bean ownership by crushers was/is adequate and crushers had the opportunity to forward hedge margins at good levels. March forward we anticipate crush falling off sharply. Domestic crushers will be battling with exporters for remaining soybeans and bean ownership will fall off along with weaker forward margins. This is starting to show some already with forward product offers thinning. As a result, we foresee soyoil stocks tightening from current levels, which should be supportive to cash soybean oil levels that are already at very expensive values compared to recent years. Will this drop-off in crush be enough for the USDA to hold its crush estimate? Unlikely in our view. When this analysis of crush is combined with what appears to be an underestimated U.S. soybean export estimate, it’s looking like soybean prices may not have done enough work to the upside yet to ration demand. We will the USDA’s latest thinking on this tomorrow when they update their soy balance sheets for the February WASDE.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.