By Michael Irgang, Global Risk Management Inc.

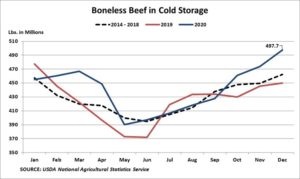

The USDA’s January 2021 Cold Storage report pegged total inventories of boneless beef in cold storage on 12/31/2020 at 497.7 million pounds, an increase of 23.8 million pounds, or 5.0%, from the prior month. This inventory build for the month of December is higher than the normal inventory change from November to December of a build of only 3.1% and it is the largest 12/31 balance since 2016. On the surface, this report appears to be welcome news for buyers as beef demand for 2020 was, by some measures, the strongest in over fifteen years. Boneless beef, which is comprised primarily of beef trimmings at the higher lean points, has been in great demand in recent months. Lean trimmings are primarily used in ground beef products. Consumer demand at Grocery/Retail channels has been strong due to the elevated number of at-home meal occasions and of course, for the buildup in demand for upcoming Super Bowl celebrations (think chili & tacos). QSR demand for lean trimmings in hamburger patty production has also been robust. But the question remains, does an increase in cold storage supplies really mean increased availability for U.S. grinders? Our contention is that it doesn’t.

Here is why:

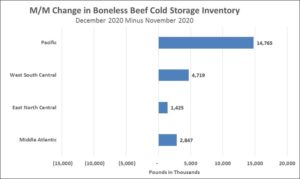

The USDA breaks our cold storage data for boneless beef by the four regions: Pacific, West South Central, East North Central, and Middle Atlantic. The chart at the bottom shows the inventory changes in boneless beef in cold storage from November to December by Region. It is interesting to note that the inventory build in the Pacific region (California, Washington, Oregon, Alaska, & Hawaii) is a whopping 14.8 million pounds, or 62%, of the total increase for the month. Cold storage facilities in the Pacific region are often used as staging facilities for U.S. boneless beef going into overseas export markets. The fact that USDA data also showed an increase in export orders for U.S. beef in December provides support for our contention that the build in the Pacific is likely destined for Asian markets. Given the limited offering from Australia for boneless beef during December and the weaker U.S. dollar, we can conclude the inventory build overall is driven largely by export sales.

This analysis demonstrates the importance of digging into the details of USDA reports; doing so can lead to different conclusions regarding available supple of product. Furthermore, this analysis leads Global Risk Management to view the January Cold Storage report as somewhat bullish for boneless beef prices.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.