By Patrick Sparks, Global Risk Management Inc.

A continuation of cooler than normal ocean temperatures in the Pacific means a La Nina is in full effect!

Often referenced but frequently misunderstood, La Nina’s and its close relative El Nino can have significant impacts on agricultural production. In general, a La Nina is a global weather event spurred on by cooling of ocean surface temperatures in parts of the Pacific Ocean. GRM’s internal measuring stick for a La Nina to be called has hit its mark, leading us to officially pencil the 20/21 season a La Nina year!

Despite what often catches the headlines, one must know not all La Nina’s are created equal. Their effect can have worldwide reach with different regions experiencing different climatic conditions, some favorable and some not. Additionally, La Nina’s can be weak or strong in any given year, altering its potential impact on agricultural production.

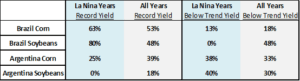

Agricultural commodity production and La Nina patterns are cyclical in nature, allowing us to learn from the past. With an active La Nina, we studied its historical tendencies to look for future signals. With this year’s new found sensitivity in soybean and corn balance sheets, led by record US export commitments, the development of South America’s crops are under close watch. Because of this, we focused our attention for possible trends in La Nina years for South American production. After analyzing yield and production data back to the 1970’s, GRM flagged soybean production in Argentina as being one of the most at risk to crop downgrades under a La Nina formation. Brazil did not show any consistent pattern of crop issues under a La Nina. During La Nina years, not once did Argentine soybean yields set a record and 40% of those years saw below trend yields.

Looking at weather maps in Argentina would tell you La Nina is having its way, as soil moisture deficits have expanded. It’s important to note Argentina had been dry coming into the La Nina, possibly intensifying this year’s effects. The Buenos Aires Grain Exchange rates the Argentine soybean crop at 50% good/excellent. That’s down 5 points from the prior week and compares to 53% at this time last year. The USDA has already been aggressive on Argentina by reducing the soybean crop a total of 3.5 MMT to 50 MMT in the last two WASDE reports. The US Climate Prediction Center sees 95% odds that La Nina will last through March, which would cover the majority of the crop’s key vegetative stages. With the crop not even fully planted at this point (~65%), there’s certainly time for rains to come and conditions to improve, but knowing La Nina history and looking at forecasts, our confidence in this is low at the moment. With the economic issues in Argentina and slow farmer selling, further production cuts would be bullish to soybeans and its products, oil and meal.

Commodity trading is not suitable for all investors. There is an inherent risk of loss associated with trading commodity futures and options on futures contracts, even when used for hedging purposes. Only risk capital should be used when investing in the markets. Past performance is not indicative of future results.